Pursuit Gate - Let’s Develop a Capture Plan!

#012 Does your opportunity have sufficient PGo, Pwin, and PTW?

Before pursuing any potential opportunities, companies must assess them based on specific criteria that align with their overall strategic goals. These criteria can include factors such as the likelihood of winning, is the opportunity funded (PGo), is there sufficient time to respond, access to comprehensive customer information, and whether the opportunity falls within our targeted business market.

We have successfully qualified an opportunity through a Gate 1 briefing. This briefing allowed our Business Development(BD) manager to present an overview and business case for why our small business should pursue the opportunity. Now, we have the green light to start developing a capture plan.

A capture plan is crucial for increasing our chances of success (Pwin). The sooner we identify and qualify an opportunity, build relationships, gather relevant data, and develop a winning strategy, the stronger our proposal will be.

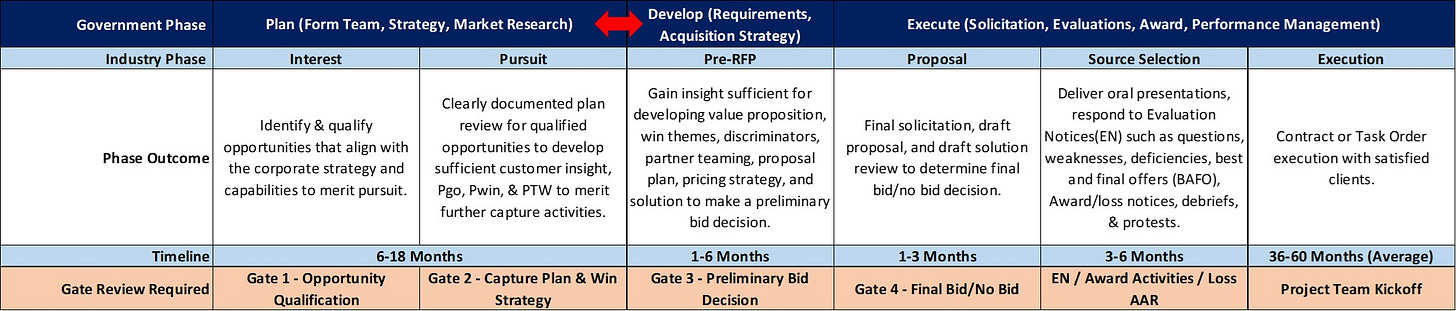

Let's dive into the phases of the capture plan and what we aim to achieve in the Pre-RFP, Proposal, and Source Selection stages. The anticipated government phase is highlighted in dark blue at the top, with some overlap between the Plan and Develop stages indicated by the red arrow. Each industry phase (light blue) has a gate brief that signifies a desired end state for progressing through the capture process.

The timeline or Procurement Administrative Lead Time (PALT), can vary depending on the acquisition team, type, and size of the procurement. I’ve seen small business opportunities recompete in as little as 4 weeks from start to finish and another I’ve have been chasing that’s at 3+ years and counting!

The Gate Reviews shown in the graphic represent presentations to an executive who ultimately makes the decision on whether to proceed. It's important to note that this is a modified version based on the Shipley model, which includes Gate 0 through Gate 5. In a small business, the Gate 0 decision is typically made by the BD manager when initially identifying work on a forecast or business intelligence management tool. Gate 5, which is the Proposal Submission Gate, is not shown here. As a small business, you will likely go through this gate as part of the proposal process after Q&A or during a review (pink/red/gold team).

Our capture plan is designed to answer critical questions necessary to proceed to the next gate. We gather information that will increase our probability of winning (Pwin), ensure that our assessed Price-to-Win (PTW) is profitable and executable. We focus on gathering opportunity information, assessing our corporate capabilities, analyzing the customer and procurement landscape, conducting competitive analysis, developing a win strategy, and creating solutions. This involves engaging with customers and the incumbent to understand the government's pain points and desired solution.

Gate 2 – Pursuit Brief: Reviewing the Capture Plan

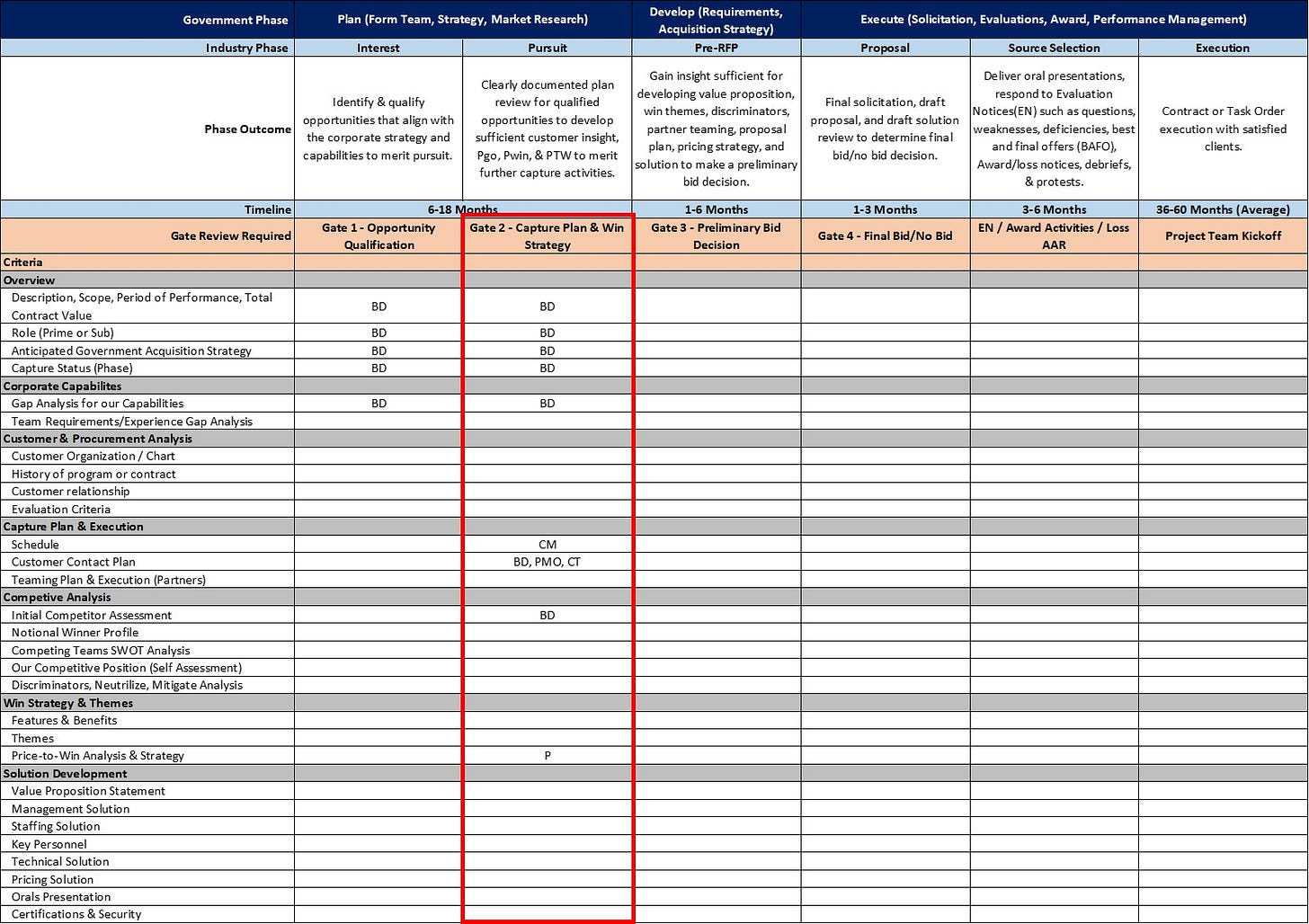

Let’s develop the pursuit brief and review the capture plan! After our last brief, we developed a capture plan as seen below and have several areas where we need to answer questions, in order to proceed. Just like the last time, this isn’t a “gotcha” brief, but you should be fully prepared and anticipate questions from your audience. Below are a list of areas on our capture plan for Gate 2 that need to be addressed.

Legend - Business Development (BD), Capture Manager (CM), Program Management Office (PMO), Contracts (CT), and Pricing (P).

Opportunity Overview

The template follows our Gate 1 briefing, providing any updates to the opportunity description and acquisition strategy. Additionally, you should provide updates on Bid & Proposal funding (travel, conferences, proposal management, pricing, or other expenses) necessary to win the contract.

Capability and Solution

Do we have the technical capability and capacity to perform the work? Our solution should accurately reflect the capability and capacity we must deliver on the government’s needs. Should we engage consultants or strategic hiring initiatives? Would recruiting personnel from the current program or customer enable us to add knowledgeable personnel with experience in the right areas in our company? We also need to consider the possibility of subcontractors who can add additional value, customer insight, and capacity where needed. Conducting a full gap analysis, customer call plans, and incumbent engagement will help identify what our best solution.

Customer Information

Understanding the customer's underlying problem or pain points is a critical first step. It's important to dive deeper and ask questions that will help uncover what is really driving them during this acquisition - and how they could benefit from having your solution.

By getting a better idea of what results they are seeking, and why, you can gain invaluable insight into why this is important to the customer. It's also helpful to know how success can be measured, so you can ensure that your solution is meeting and exceeding their expectations.

Finally, it's essential to determine which result is the most important for the customer, as this will help inform the direction of your sales strategy and aid in delivering an outcome that they will be satisfied with.

At the end of the day, customer understanding is essential for success. It's important to develop a call plan to ask questions and uncover what matters most to them, as this will help you provide a tailored solution that is sure to meet their needs. Remember, call plans aren’t just picking up the phone – it can be meeting clients at events, technical engagements during industry days, and visiting the client site.

Competition

It’s important to conduct an initial competitive assessment based on the BD lead’s understanding of who might be interested in pursuing the opportunity. This should include both prime and subcontractors. Have you assessed whether or not they are viable? Is there a possibility of taking them off the street and adding them to your team? The BD lead should consider meeting with both large and small businesses to assess whether they would be a good partner or whether they are likely to be a competitor or on a competitor’s team.

Top-down Price-to-win (PTW) Analysis is critical to ensuring your organization can execute the work and remain profitable. Based on your current competitors, do you understand where your rates fall? Have you identified the total contract value of the prior work? Have you reviewed the most recent data on burn rate for the opportunity? Has the customer identified any increases in scope, labor categories, consolidation of other programs, or descoping of the current requirements? Answering all of these questions will determine your PTW.

Win Probability (Pwin) Assessment (Current and at Submission) – have you updated your company’s Pwin matrix? Many companies have a weighted matrix that attempts to quantify their chances of a win – these questions could be based on marketing to the customer, identification of the customer preferences or knowledge of our company, understanding of the technical/management/cost requirements, incumbency, and whether you have past performance.

Positioning and Win Strategy

To successfully position ourselves for a win, it is essential that we have a comprehensive understanding of the customer. We need to understand their needs, objectives and current "as-is" state. This involves taking a step back and analyzing our customer's challenges holistically for us to be able to create an effective value proposition, aligned to our team’s capabilities, that can meet these needs.

We need to start by defining our vision of the customer's "to-be" state and what we need to do to shape their requirements towards this goal. This means understanding their challenges, technology capabilities and resources available - as well as how they go about making decisions so that we can align our propositions accordingly. We also need to consider how we can differentiate ourselves from the competition and why they should choose us as their partner.

By taking the time to assess and understand our customer holistically, we can develop a differentiated value proposition that meets their needs and objectives - positioning ourselves for a win. Taking an in-depth look at their challenges, technology capabilities and resources available allows us to create an effective value proposition - ensuring that our positioning is successful and that we can offer them the solutions they need.

Risk Assessment

Are there potential risks or capabilities that we need to mitigate? If so, have we developed plans to mitigate these risks? Are we missing certifications, past performance, or ability to work in geographically separate regions (OCONUS)? Maybe we have 75% of technical capability but need a subcontractor for the other 25%. Have we identified a partner or two that can provide redundancy and fill the gap?

Plan to Improve PWIN

The last section of our Gate Brief should be identifying what actions need to occur for improving our PWIN. Furthermore, understanding customer sentiment allows us to gain a better understanding of how customers feel about our business and its offerings. This is an important factor when trying to improve PWIN as it provides us with feedback that can help us identify areas where we can make improvements or better support customers. A thorough understanding of our competitors, their past performance, and their technical capabilities can help us tailor our solutions to meet customer needs more effectively.

To effectively grow and expand our business, we need to develop a strategy for shaping and influencing customers’ perceptions of us and our solution. This could include developing targeted marketing campaigns, utilizing strategic hires, and increasing brand visibility. By developing a strong shaping/influence/marketing plan and utilizing customer research and market analysis, we can ensure that our solutions are meeting the needs of customers as well as improving PWIN.

To better understand customer needs and preferences, it is essential that our team has a plan for engaging customers and having meaningful conversations. This can be done through customer calls, 3rd party surveys, or other methods of direct communication.

When developing a customer call plan, it is important to consider the following points:

Create customer profiles to identify ideal participants for calls using the org chart.

Develop an agenda that focuses on gathering information about customer preferences and needs.

Create a script to ensure that key questions are asked of each customer.

Allow for open-ended discussion to gain additional insights from customers.

Conduct baseline data gathering to measure the impact of our strategies for improving PWIN. This allows us to track changes over time and identify which strategies are most effective.

Create a Solution Development Plan to improve PWIN. It is essential to have a plan in place for developing solutions that meet customer needs based on the information you collect through customer engagement and incumbents. This includes defining the scope and objectives of the project, setting deadlines, allocating resources, and creating action plans.

Lastly, ensure your Capture Schedule and Resource Plan is clear. This ensures that the project stays on track and that resources (time, money, staff) are utilized effectively.

By following these steps, we can ensure that our plans for improving PWIN are comprehensive and effective. Additionally, by utilizing customer research and market analysis, we can ensure that our solutions meet customers’ needs and provide them with the greatest value. By taking a proactive approach to improving customer experience, we can ensure that our strategies are successful and get us a win!